Bad Debt Piled in Italian Banks Looms as Next Crisis

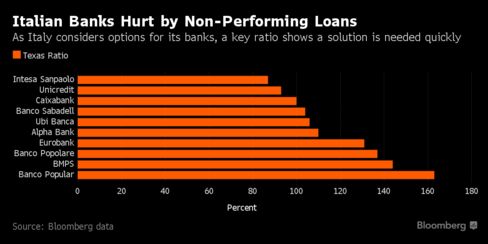

MILAN—Britain’s vote to leave the EU has produced dire predictions for the U.K. economy. The damage to the rest of Europe could be more immediate and potentially more serious. Nowhere is the risk concentrated more heavily than in the Italian banking sector.

The average funded ratios of the top 100 U.S. corporate pensions are expected to fall to the lows seen in 2012 as the U.S. 30-year yield has fallen half a percentage point and yield premiums on corporate bonds also have declined since April, according to Bank of America analysts.

New vehicle sales in Brazil plunged in the first half of the year, as the country's economic recession persisted in the period, hurting consumer confidence.

The impact of the deep recession in neighbouring Brazil on Argentine businesses has been fully exposed — data from a consultancy firm revealed yesterday that exports by the local industrial sector to Latin America’s biggest economy have slumped by a staggering 24 percent over the last six months.

World’s Top Oil Trader Says Prices Won’t Rise Much Further

Vitol CEO Ian Taylor says crude to end 2016 near $50 a barrel Sees weaker demand growth in China and the rest of Asia Oil prices won’t rise much further over the next year and a half as demand growth slows and refiners comfortably meet gasoline consumption, according to the world’s largest independent oil-trading house . “I cannot see the market really roaring ahead,” Vitol Group of Cos. Chief Executive Officer Ian Taylor told Bloomberg Television in an interview. “We have a lot of oil in the system and it will take us considerable time to work that off.” Since rallying from a 12-year low of $27.10 a barrel in January, Brent crude has been hovering around $50 a barrel for the last month. The international benchmark will probably end the year “not too far away from where we are today” and rise to about $60 by the end […]