The Potential Bubble the Federal Reserve Cares Most About

In the aftermath of the 2008 financial crisis, economists debated whether the Federal Reserve should be involved — at all — in pricking bubbles. The housing bubble, and subsequent financial crisis, had led to a disastrous result: Hundreds of banks had failed and millions of Americans had lost their jobs. At the time, many still believed the emergence of future bubbles could only be prevented through financial regulation, and not through interest rate hikes.

Today, however, as interest rates remain at historically low levels and are expected to stay low at least into next year, there is growing concern among investors, economists and central bankers that a new bubble has emerged, and that increased regulation isn’t enough to stop it. Led by a powerful Fed governor, there’s a growing call for the Federal Reserve to raise interest rates to prevent this bubble from growing.

So what bubble are we talking about? It’s not the one you might expect.

Read More

This

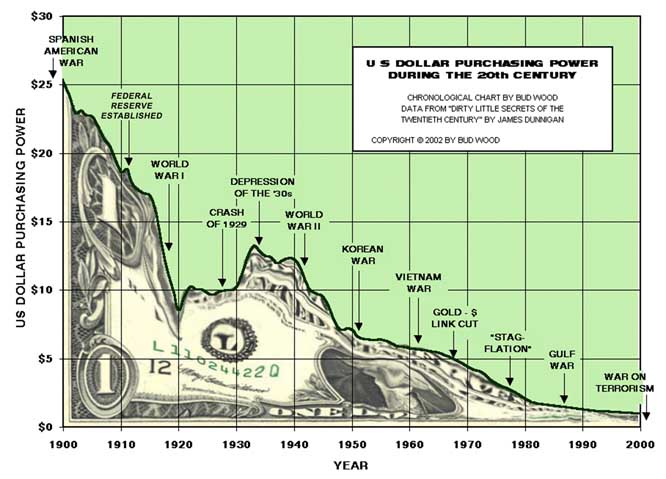

is very bad for future generations as there is no connection any more

between money and a physical capability to deliver tangible value of

any sort over time. Sowing the seeds of hyper-inflation and thus

complete debasement. This also puts more and more pressure on the US

hegemony to continue geo-political engagements in order to protect

natural resource interests; thus what is left of the dollar's physical

value and its image and status as a reserve currency.

This

is very bad for future generations as there is no connection any more

between money and a physical capability to deliver tangible value of

any sort over time. Sowing the seeds of hyper-inflation and thus

complete debasement. This also puts more and more pressure on the US

hegemony to continue geo-political engagements in order to protect

natural resource interests; thus what is left of the dollar's physical

value and its image and status as a reserve currency.

Coming generations are hence unwittingly being conscripted into future conflicts around the world as a consequence of these policy actions. The total system's inertia now however is so great that there are almost no other choices. When this ride began, there was just no way to disembark halfway or otherwise . Perhaps.

On reflection one might ask - when did it begin? Why?

Because there... ain't no stopping us now!

Investors' Insights

April 21, 2014

Comments

This

is very bad for future generations as there is no connection any more

between money and a physical capability to deliver tangible value of

any sort over time. Sowing the seeds of hyper-inflation and thus

complete debasement. This also puts more and more pressure on the US

hegemony to continue geo-political engagements in order to protect

natural resource interests; thus what is left of the dollar's physical

value and its image and status as a reserve currency.

This

is very bad for future generations as there is no connection any more

between money and a physical capability to deliver tangible value of

any sort over time. Sowing the seeds of hyper-inflation and thus

complete debasement. This also puts more and more pressure on the US

hegemony to continue geo-political engagements in order to protect

natural resource interests; thus what is left of the dollar's physical

value and its image and status as a reserve currency.Coming generations are hence unwittingly being conscripted into future conflicts around the world as a consequence of these policy actions. The total system's inertia now however is so great that there are almost no other choices. When this ride began, there was just no way to disembark halfway or otherwise . Perhaps.

On reflection one might ask - when did it begin? Why?

Because there... ain't no stopping us now!

Investors' Insights

April 21, 2014