Investors' Insights Comments

Any serious investor who believes that the CPI numbers (etc.) created by governments everywhere are real and accurate is the sort of bigger fool everyone is looking for - to support many ventures. Now, sooner or later, the markets are going to wake up to this reality,inclusive of China, to Greece to Brazil and the USA, plus many more - and then watch the proverbial "you-know-what ' hit the fan.

In turn, the spin doctors and other Pinocchios will be fully employed in very secure long-term activities as they seek to baffle the feeble-minded towards ratification and consumption. So yes, Eric Sprott is right.- so Is Noam Chomsky; so was John Steinbeck..

Never forget Arthur Anderson, Enron , China, the Fed, and all the rest. For as always, remember this utter wisdom - figures lie, only because liars figure.

Beware, and good luck!

August 31, 2015

Lies You Will Hear As The

Economic Collapse

Progresses

It is undeniable; the final collapse triggers are upon us, triggers alternative economists have been warning about since the initial implosion of 2008. In the years since the derivatives disaster, there has been no end to the absurd and ludicrous propaganda coming out of mainstream financial outlets and as the situation in markets becomes worse, the propaganda will only increase. This might seem counter-intuitive to many. You would think that the more obvious the economic collapse becomes, the more alternative analysts will be vindicated and the more awake and aware the average person will be. Not necessarily...

In fact, the mainstream spin machine is going into high speed the more negative data is exposed and absorbed into the markets. If you know your history, then you know that this is a common tactic by the establishment elite to string the public along with false hopes so that they do not prepare or take alternative measures while the system crumbles around their ears. At the onset of the Great Depression the same strategies were used. Consider if you've heard similar quotes to these in the mainstream news over the past couple months:

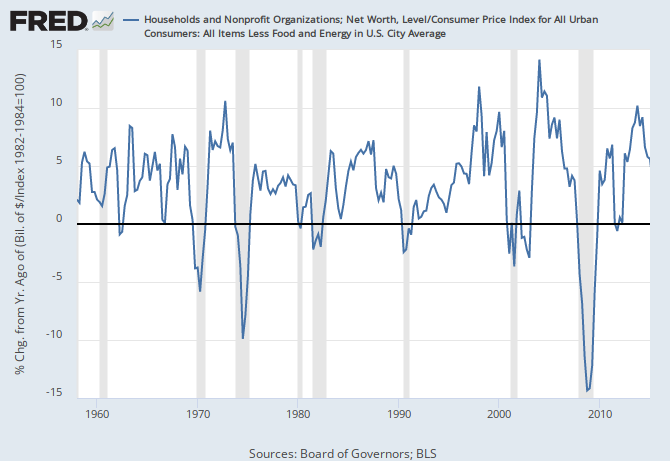

The Fed’s preferred measure of inflation shows that prices rose 0.3 percent during the 12 months ending in July, well below the 2 percent annual pace the Fed considers healthy. A narrower measure excluding food and oil prices, which the Fed regards as more predictive, increased 1.2 percent over that same period.

Venezuela seems to be hovering on the edge of tipping into hyperinflation. Or perhaps it has already fallen into the abyss. Given the paucity of official data -- the none-too-believable official figures were last published in February -- it's a little hard to tell.

Industrial overcapacity, a build-up of corporate debt and a $5 trillion stock-market slump are making it harder for Premier Li Keqiang to prevent a deeper economic slowdown. The combined earnings of China’s five biggest banks are projected to rise 2 percent this year, the least since at least 2004, according to analysts’ estimates compiled by Bloomberg.

There’s a saying common in education circles: Don’t teach students what to think; teach them how to think. The idea goes back at least as far as Socrates. Today, what we call the Socratic method is a way of teaching that fosters critical thinking, in part by encouraging students to question their own unexamined beliefs, as well as the received wisdom of those around them. Such questioning sometimes leads to discomfort, and even to anger, on the way to understanding.

What I really worry about is that transition from one financial scheme to the next is never done peacefully. The hegemon that has the printing press, that has the reserve currency, they don’t just sit back and say we’ve had our time in the sun. Now it’s your turn. No, they fight as hard as they can to protect and defend that. That’s my biggest concern.

Eric Sprott Was Right,

Inflation Is Rising

Eric showed the above table in his presentation. It shows that the true level of inflation, a persistent increase in prices, has been sitting around 10% since 2011. Indeed, a far worse picture than what the US Federal Reserve paints. The Fed argues that prices have been rising below 2% for the past four years. That said, the Fed doesn’t include food, petrol and taxes in its inflation index. This is similar to the Reserve Bank of Australia’s inflation calculation.

But then who needs petrol and food, right?

And it’s only going to get worse…

A Passing Thought...