U.S. Debt Dump Deepens In 2016

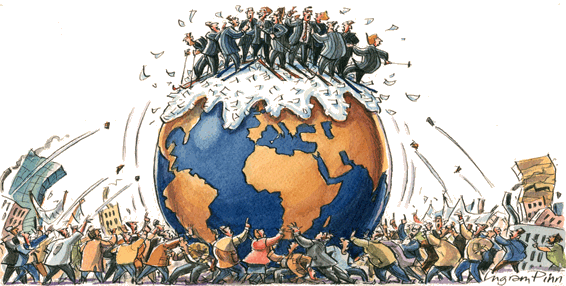

NEW YORK (CNNMoney) — Central banks are dumping America’s debt at a record pace.

China, Russia and Brazil sold off U.S. Treasury bonds as they tried to soften the blow of the global economic slowdown. They each sold off at least $1 billion in U.S. Treasury bonds in March.

In all, central banks sold a net $17 billion. Sales had hit a record $57 billion in January.

So far this year, the global bank debt dump has reached $123 billion.

In all, central banks sold a net $17 billion. Sales had hit a record $57 billion in January.

So far this year, the global bank debt dump has reached $123 billion.

It’s the fastest pace for a U.S. debt selloff by global central banks since at least 1978, according to Treasury Department data published Monday afternoon.

Treasuries are considered one of the safest assets in the world, but some experts say a sense of panic about the global economy drove the selloff.

“It’s more of global fear than ...

The crisis in Venezuela is worsening everyday due in part to shortages reaching 70 percent. This to go along with the world’s highest level of inflation.

When Abe launched his administration with bold promises to shake Japan from its deflationary torpor, consumer sentiment surged and shoppers splashed out on big-ticket items. But now, opinion polls show a majority of voters are losing faith in "Abenomics", as well as in the BOJ's radical monetary stimulus, and consumer sentiment is weakening.

The IMF’s push to lock in low interest rates for Greece for decades to come is hard for the eurozone to digest. The bloc’s bailout vehicles, such as the European Stability Mechanism, would then need subsidies from national budgets to cover a part of their own funding costs. IMF staff “like solutions that imply budgetary transfers,” said a European official.

Iran’s May Oil Exports Set to Surge Nearly 60 Percent From a Year Ago: Source

Iran’s oil exports are set to surge in May, climbing nearly 60 percent from a year ago, with European shipments recovering to about half of pre-sanction levels, according to a source with knowledge of the country’s crude lifting plans. This shows Tehran is regaining market share at a faster pace than analysts had projected as it battles with Saudi Arabia for customers by cutting its prices. April loadings at 2.3 million barrels per day (bpd) were around 15 percent higher than the International Energy Agency estimated earlier this month. May shipments are set to jump to 2.1 million bpd from 1.3 million bpd during the same month in 2015, when Iranian exports were constrained by Western sanctions imposed because of the country’s nuclear program. The April loadings […]