Saudi Arabia Takes Out $10bn in Bank Loans

Saudi Arabia is raising $10bn from a consortium of global banks as the kingdom embarks on its first international debt issuance in 25 years to counter dwindling oil revenues and reserves. The landmark five-year loan, a signal of Riyadh’s new found dependence on foreign capital, opens the way for Saudi to launch its first international bond issue. It comes as the sustained slump in crude encourages other Gulf governments, such as Abu Dhabi, Qatar and Oman, to tap international bond markets. The oil-rich kingdom, which last weekend blocked a potential deal among oil producers to freeze output and bolster prices, has burnt through $150bn in financial reserves since late 2014 as its fiscal deficit is set to widen to 19 per cent of gross domestic product this year...

Investors' Insights Note:

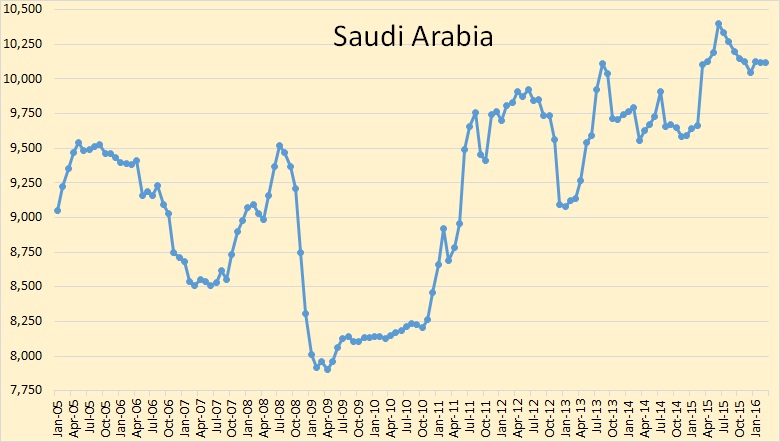

Saudi is producing every barrel they possibly can. They will be lucky to hold this level for much longer.

...Strong interest in the loan, especially from Asian banks, came despite rating agency downgrades on Saudi creditworthiness since the oil price collapsed. The government raised the amount it wanted to borrow from $6bn-$8bn to $10bn after the deal was oversubscribed.

What Is the ‘Magic Number’ for the Price of Oil?

There are some signs that the influence of oil on other assets may be fading…. Here’s a number to focus on: $50. That’s per barrel, the price of Brent crude oil at which falling prices started to hurt rather than help shares and other risky assets. Monday’s 6% fall and rebound in oil pushed equities down and back up, once again demonstrating its importance. Brent prices rose 2.6% to $44.03 Tuesday, well within sight of $50. Despite the obvious impact on Monday, there are some signs that the influence of oil on other assets may be fading. If the price keeps going up, the question is not only whether it will carry on, but whether more expensive oil will continue to be good news for shares. The answer depends to a large extent on the explanation for why the link was so tight to begin with. Wind back to […]

There are some signs that the influence of oil on other assets may be fading…. Here’s a number to focus on: $50. That’s per barrel, the price of Brent crude oil at which falling prices started to hurt rather than help shares and other risky assets. Monday’s 6% fall and rebound in oil pushed equities down and back up, once again demonstrating its importance. Brent prices rose 2.6% to $44.03 Tuesday, well within sight of $50. Despite the obvious impact on Monday, there are some signs that the influence of oil on other assets may be fading. If the price keeps going up, the question is not only whether it will carry on, but whether more expensive oil will continue to be good news for shares. The answer depends to a large extent on the explanation for why the link was so tight to begin with. Wind back to […]Brent signals traders to release oil stocks: Kemp

Crude oil storage helped commodity traders and refiners make strong profits last year and in the first quarter of 2016 but now the price structure which made it possible is evaporating. In a typical storage strategy, known as “cash and carry”, traders buy physical crude and put it into storage in a tank farm, or more rarely on a tanker at sea. Traders simultaneously sell crude futures for a nearby contract, hedging their exposure in case prices fall while the oil is stored. As the futures contracts near expiry, traders buy them back and sell more contracts for a date further in the future. The strategy continues until the trader is ready to release the stocks back to the market. But the strategy only works if the futures market trades in contango, with contracts near expiry […]

Oil bulls will be the losers as technology upends demand

The bullish camp, which includes Opec and EIA, has recently reinforced their $80/bbl target by 2020 based mainly on “battle for supply” (competition among oil producing nations and technologies) arguing that low prices will result in postponed or cancelled investments and permanent loss of production capacity, which combined with their optimistic outlook for oil demand, would allow the cartel to regain control and sustain high prices.

The bearish camp believes in “lower for longer”, below the current spot, and much lower than the $50/bbl currently implied by the 2020 futures. The bearish view acknowledges the “battle for supply”, not only for crude oil but also for natural gas, as well as the “battle for demand” (competition among fuels) where refined oil products (such as gasoline, diesel or jet fuel) compete for market share in transportation demand with alternative energy sources and technologies (such as natural gas, renewables, electricity or batteries); a dramatic change that would erode the cartel’s oligopolistic power.

Lithium War Heats Up After Epic Launch

Of Tesla Model 3