Investors' Insights Comments

There is little doubt we are in the midst of a perfect financial storm, that history will perhaps one day record as "The Mother of All Global Market Crashes". Interest rates were too low, for too long, that created unsustainable bubbles in financial and real estate markets around the world.This time it is different was again the usual mantra.

It never is. It Never Will Be. It couldn't last!

Mathematically, everyone denied that a mean reversion of interest rates would ever occur and thereby collapse global asset bubble values everywhere by 50% or more. Guess what? Somebody bought that last tulip, and we are now experiencing the reversion with the full brunt of its present value mathematical consequences.

Moreover, many economies are facing debt woes and physical economic and climate change issues causing either water,capital or food shortages. You cannot run economies without food, water and energy, but somehow Nobel Prize nor Ivy League economists can never figure this out.

The FED charts tell us the financial market weather is very bad. Wall St is getting very worried and today's world headlines tell the story of a free fall in values in Japan, China, Australia and elsewhere, that mirrors all the great stock, bond and economic meltdowns of past and recent history. Plunging prices for days and weeks on end - because we just run out of bigger fools..The real laws of supply and demand.

If you have a feeling that things are about to get much worse. One thing you need not worry about, you are not alone.

And remember that old adage - when its over, its over!

Mathematically, everyone denied that a mean reversion of interest rates would ever occur and thereby collapse global asset bubble values everywhere by 50% or more. Guess what? Somebody bought that last tulip, and we are now experiencing the reversion with the full brunt of its present value mathematical consequences.

Moreover, many economies are facing debt woes and physical economic and climate change issues causing either water,capital or food shortages. You cannot run economies without food, water and energy, but somehow Nobel Prize nor Ivy League economists can never figure this out.

The FED charts tell us the financial market weather is very bad. Wall St is getting very worried and today's world headlines tell the story of a free fall in values in Japan, China, Australia and elsewhere, that mirrors all the great stock, bond and economic meltdowns of past and recent history. Plunging prices for days and weeks on end - because we just run out of bigger fools..The real laws of supply and demand.

If you have a feeling that things are about to get much worse. One thing you need not worry about, you are not alone.

And remember that old adage - when its over, its over!

Trouble Abrewing; This Time It Is Different

"The BIG Market Warning"

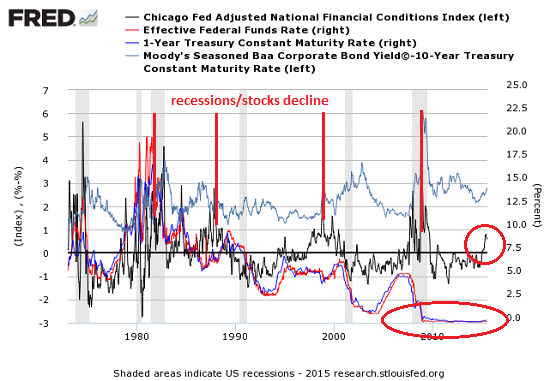

We've seen a lot of extraordinary extremes and divergences in the past fifteen years, but nothing quite like this. Courtesy of longtime correspondent B.C., here is a chart of the Chicago Fed's National Financial Conditions Index, the Fed Funds Rate and the 1-Year Treasury Yield, and a measure of corporate bonds and the 10-year Treasury yield.

When the National Financial Conditions Index rises above the zero line, bad things tend to happen to the stock market and the economy. This index spiked before the recessions in 1977, 1981, 2000 and 2008, and rose before the stock market nosedived in 1987.

Meanwhile, the Fed Funds Rate and the 1-Year Treasury Yield have been bouncing along the zero boundary since late 2008. In the past 40 years, we've never seen the Fed Funds Rate and the 1-Year Treasury Yield effectively at zero for such an extended time, and the National Financial Conditions Index moving decisively higher.

This time it is different, but not in the way that the cheerleaders intended.

While the deficit has been dropping, the province’s total debt outstanding has been rising and now stands at about C$315 billion, according to the Ontario Financing Authority. Ontario’s C$250 billion of long-term bonds rated by Moody’s Investors Service is the most of any province, state or local government in the world, the New York-based company said last year.

Investigators, including the US auditing firm Kroll, are looking into the matter but have released few details. The speaker of Moldova's parliament finally released a report by Kroll late Monday night that implicated a Moldovan businessman in the scheme, but recommended further investigation.

Many Moldovans are mad about all this.

If you are a fan of mafia movies, you know how the mafia would take over a popular restaurant. First, they would do something to disrupt the business – stage a murder at the restaurant or start a fire. When the business starts to suffer, the Godfather would generously offer some money as a token of friendship. In return, Greasy Thumb takes over the restaurant’s accounting, Big Joey is put in charge of procurement, and so on. Needless to say, it’s a journey down a spiral of misery for the owner who will soon be broke and, if lucky, alive.

I went back through historical records, back before the global financial crisis revealed just how poorly managed America really is, and I pulled Bureau of Labor Statistics (BLS) employment data from two periods: the peak just before the global financial crisis in 2007 to 2008, and as of May 2015. I cross-referenced the data with other numbers the BLS publishes on average weekly earnings.

I went back through historical records, back before the global financial crisis revealed just how poorly managed America really is, and I pulled Bureau of Labor Statistics (BLS) employment data from two periods: the peak just before the global financial crisis in 2007 to 2008, and as of May 2015. I cross-referenced the data with other numbers the BLS publishes on average weekly earnings.

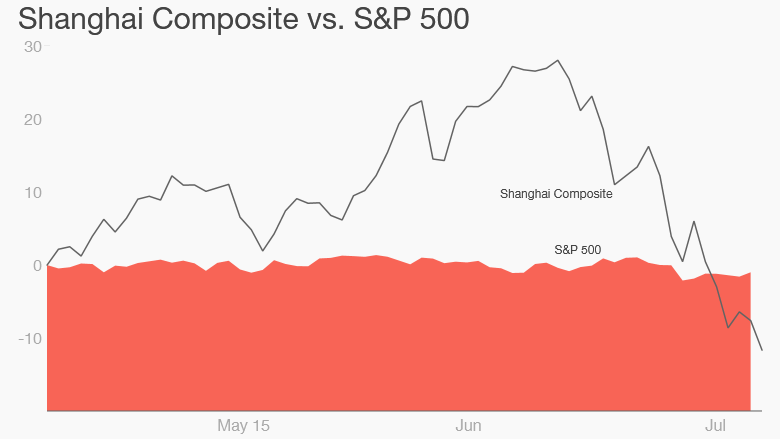

The measure, which comes after the exchange made it more expensive to speculate on stock-index contracts, is intended to curb short selling and won’t work, according to Xinhu Futures Co. China’s state-run media has blamed rumor-spreading short sellers and foreign investors for a stock-market rout that erased more than $3.2 trillion of value in less than a month.

In a report released Tuesday, the IMF said that prolonged low interest rates "pose a slow burning solvency risk" for life insurers. If low rate stay until 2018, 11 out of 18 life insurance groups would report negative shareholder equity, the IMF said.

More Leading Global Headlines

Greek Banks Prepare Plan To Raid Deposits

U.K. Welfare Spending Increases $43 Billion Under Cameron

Chinese Trading Suspensions Freeze $1.4 Trillion of Shares Amid Rout

Central Banks Across the World Pressured to Fight Against Euro Depreciation

European Central Bank’s Nowotny: If Greece Misses Payment, Funds Will Be Cut Off

IS EXISTENTIAL REALITY

Science or Archaic Fabrications?