China's stock market remains jittery after greatest losses since 2007

Beijing vows to buy stocks to prop up stock market, regulator says, as shares slump then rise after Monday’s frenzied selling

Beijing has vowed to step up its interventions in China’s volatile stock market following a traumatic day on Monday when stocks suffered their greatest lossessince 2007.

Beijing has vowed to step up its interventions in China’s volatile stock market following a traumatic day on Monday when stocks suffered their greatest lossessince 2007.

A government-controlled stock-buying agency would “continue to buy stocks to stabilise the market”, said Zhang Xiaojun, a spokesperson with China’s security’s regulator, the CSRC.

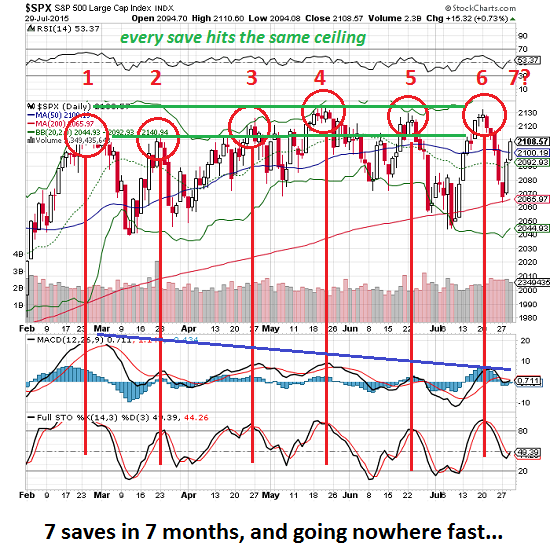

7 "Saves" in 7 Months: A Market Going

Nowhere Fast

Can markets be saved an eighth time, a ninth time, a tenth time this year? How about next year?

What do we make of a stock market that's been "saved" seven times in a mere seven months? Saved from what, you ask? Saved from rolling over, of course; after six years of upside, the current uptrend is getting long in tooth, and evidence of global recession is mounting.

What's "saved" the market seven times in seven months? The usual burps of hot air: the Federal Reserve issued more mewlings (zero rates forever), Greece was "saved" again, China's crumbling stock bubble was "saved" again, and so on.

A study by Tendências consultancy, obtained by Folha, shows that households' purchasing power was R$ 240 billion (US$ 71.3 billion) in the monthly average from January to May -6.2% lower than in the same period in 2014 (R$ 256 billion, or US$76 billion). "After years of increasing consumption, it is difficult to admit to the empoverishment of Brazilians, but that's exactly what's happening," said Rodrigo Baggi, an economist at Tendências.

Venezuela and its state oil company have about $5.6 billion in bond payments due in the last three months of this year and about $10 billion in 2016, according to Bank of America Corp. estimates. Trading in credit-default swaps show an implied probability of default of 96 percent over the next five years, the highest in the world, CMA data show.

Standard & Poor’s Ratings Services downgraded 244 issuers worth $1.2 trillion in rated debt and upgraded 125 issuers with $621 billion in rated debt in the second quarter of 2015. Downgrades eclipsed upgrades around the world as geopolitical and economic risks rose, including Greece’s potential exit from the eurozone (the “Grexit”), a slowdown in economic growth in China, and the credit effect from interest rate normalization on part of the Federal Reserve System in the U.S.

The sell-off in emerging market Asia has pushed the Thai baht to a six-year low of Bt34.9 a dollar while currencies in Malaysia and Indonesia have fallen to levels unseen for nearly two decades.

Unemployment has continued to rise throughout the presidency of Francois Hollande despite a recent uptick in economic growth and a host of initiatives including state-sponsored jobs and tax breaks to spur recruitment in the private sector.

The dismal IMF forecast comes a few weeks after Italy’s central bank said the country’s public debt level had hit a new record of €2.2 trillion in May, up by €23.4 billion in a month. Italy’s public debt of more than 130 percent of GDP is second only to Greece in the eurozone.

“The countries that have yet to launch a U.S. dollar sovereign bond have missed their opportunity to lock in the ultra-low yields available during the past few years,” Ashbourne said. “The period of almost unquestioned optimism towards African sovereign debt is coming to an end.”

The probe is the latest effort by the government to crack down on reports of market manipulation after a recent equities rout wiped out nearly $4 trillion.

Learn Success: APPLY Tips From The Best

Jeff Bezos, Amazon– Jeff Bezos is a pioneer in world of internet commerce, and was instrumental in defining this space that is now defining many aspects of the internet world. It is Jeff Bezos who innovated the concept of “predictive analytics”–recommending products to customers based on search history and buying habits. Whether you like the concept or you hate it, the idea has made online commerce more profit rich and efficient, and is making online shopping a better experience for consumers throughout the world.

Top Weekly Ideas and Insights

An Inconvenient Truth:

What Happens When Science Confronts Unsubstantiated Fiction?

EXISTENTIAL REALITY

- The Last Days of Theism -