The China Syndrome: Is China Headed For A Financial Meltdown?

In the 1979 movie The China Syndrome, Jack Lemmon plays Jack Godell, a supervisor at a nuclear power plant. The facility experienced “unusual vibrations” and Jack was concerned about a potential meltdown. Today, many believe that China – a country with the world’s second largest economy – may be on the verge of a “financial” meltdown. Is China on the verge of a crisis? Has its unprecedented economic growth set the stage for a severe decline? In this article, we’ll look at China’s situation over the past two decades.

The Chinese Economy: A Retrospective View

As Greece holds a referendum that may create more uncertainties than it solves, are we looking in the wrong place for a financial crisis? In China, the authorities are in a fine sweat about a more traditional financial conundrum: a bubble in the stock market. How do you deflate it safely? Should you even try?

As with many things in China, the numbers are staggering. The two main indices – the Shanghai Composite and the Shenzhen Composite – had risen about 150% in the 12 months to mid-June. In terms of market value, that was a gain of about $6.5tn. Since then, the market has tumbled almost 30% – call it a $2tn plunge.

What’s the big deal? Shares never go up in a straight line and anybody who bought a year ago has still more than doubled their money. But there are several potential problems, at least to Beijing’s apparent way of thinking.

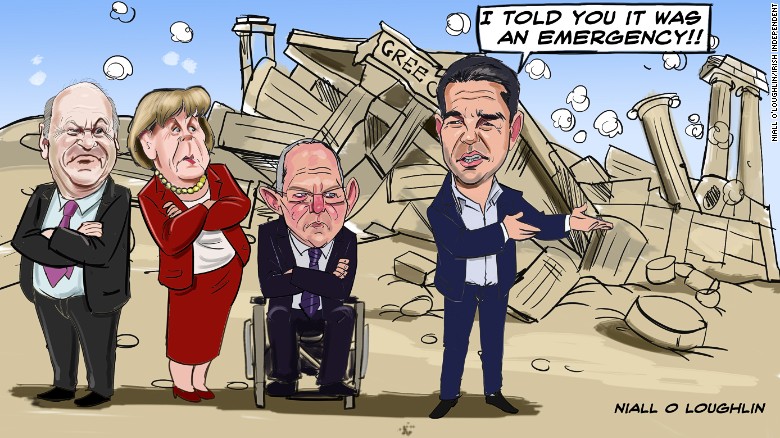

Bond yields climb in Southern Europe after Greece rejects bailout terms

Borrowing costs in Italy, Spain and Portugal climbed on Monday after Greeks decisively rejected the terms of a rescue package proposed by its international lenders. The no to the lenders' bailout demands triggered concerns the debt-laden country will leave the eurozone, sending shivers through the region's financial markets. The yield on 10-year Portuguese bondsTMBMKPT-10Y, +7.70% rose 11 basis points to 3.04%, according to electronic trading platform Tradeweb. Financing costs for 10-year Spanish debtTMBMKES-10Y, +4.06% added 8 basis points to 2.30%, while yields on 10-year Italian government paper TMBMKIT-10Y, +5.98% rose 8 basis points to 2.32%.

Greece asked to make 'credible' proposals for debt deal

Germany and France have asked Greece to make detailed proposals to revive bailout talks, a day after Greek voters decisively rejected creditors' demands for further austerity, plunging Europe into crisis.

"The door is open to discussions," said French President Francois Hollande after crisis talks in Paris with German Chancellor Angela Merkel.

"The door is open to discussions," said French President Francois Hollande after crisis talks in Paris with German Chancellor Angela Merkel.

"It is now up to the government of Alexis Tsipras to make serious, credible proposals so that this willingness to stay in the eurozone can translate into a lasting programme."

Robert J. Samuelson: Massive debt and little growth create a global debt trap

WASHINGTON — We have the Greeks to thank for an elementary tutorial in what ails the world economy. Greece's central problem is that it has too much debt and too little economic growth (none actually) to service the debt. The country is caught in an economic cul de sac. It can't seem to generate growth without spending more or taxing less, which makes the debt worse, while its creditors demand that it control its debt by spending less and taxing more, which undermines growth.

WASHINGTON — We have the Greeks to thank for an elementary tutorial in what ails the world economy. Greece's central problem is that it has too much debt and too little economic growth (none actually) to service the debt. The country is caught in an economic cul de sac. It can't seem to generate growth without spending more or taxing less, which makes the debt worse, while its creditors demand that it control its debt by spending less and taxing more, which undermines growth.Fitch says Japan fiscal discipline plan unlikely to lower debt burden

Japan's public debt burden is likely to remain high under a new fiscal framework approved last month as the government's structural reforms will not boost economic growth and tax revenue significantly, Fitch Ratings said on Monday.

Japan's fiscal plan relies almost entirely on achieving high economic growth to increase tax revenue, but there is little room for the economy to accelerate as it is already near its potential growth rate, Fitch said in a statement.

A lack of binding spending targets in the government's plan also leaves room for spending to rise further, the ratings agency said.

Rival ratings agency Moody's Investors Service also expressed concern that structural reforms could take longer to boost growth than the government expects.

TIMELINE: China’s Efforts to Stem $3.2 Trillion Stock Rout

China’s policy makers are coming up with new tactics almost every day to stem a rout that’s wiped $3.2 trillion off the world’s second-biggest stock market.

China’s policy makers are coming up with new tactics almost every day to stem a rout that’s wiped $3.2 trillion off the world’s second-biggest stock market.

Saturday June 27: *PBOC CUT: After the Shanghai Composite Index posted a 19 percent, two-week plunge, the central bank cut its benchmark lending rate and deposit rate, while also reducing required reserve ratios for some lenders

Monday June 29: Shanghai Composite rises 2.3 percent at the open before reversing course and plunging as much as 7.6 percent. Closes 3.3 percent lower.

Greek banks to stay closed for two further days - video

More Leading Global Headlines