The End of Good Times

"Home prices in the city surged 370 p ercent from their 2003 trough through the September peak, spurred by low mortgage rates, tight supply of new units and buying from mainland Chinese. This year, BOCOM International Holdings Co. property analyst Alfred Lau has said prices could fall 30 percent amid a slowdown."

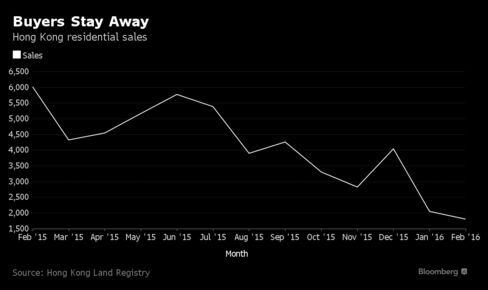

Hong Kong Home Sales Tumble 70% as Slowdown Intensifies

Hong Kong residential home sales plunged 70 percent in February from a year earlier to a 25-year low, as falling prices and economic uncertainty deterred buyers.

Last month, 1,807 homes were sold in Hong Kong, compared with 6,027 a year earlier, according to government statistics. Home sales fell from 2,045 in January, the data show.

Last month, 1,807 homes were sold in Hong Kong, compared with 6,027 a year earlier, according to government statistics. Home sales fell from 2,045 in January, the data show.

“The newspapers keep on saying the market is going down and buyers think they can get a cheaper house half-a-year later or one year later, and so are waiting," said Thomas Fok, a property agent at Centaline Property Agency in Hong Kong’s upscale Mid-levels West district where he hasn’t made one sale this year.

Property prices have declined 10 percent from their September highs amid uncertainty over the economy at home and in China, possible interest-rate increases and plans by the government to boost housing supply in the next five years. Senior Hong Kong government officials have ruled out relaxing property curbs, which include extra stamp duties and caps on mortgage levels.

With oilfield activity suddenly contracting, production from a dwindling number of freshly fracked wells would be unable to compensate for the rapid depletion of older wells. Yet that long-anticipated turning point has only just begun to emerge - partly because producers had a couple more tricks in store.

Some drillers are spending a little bit more on measures that are subtly flattening the so-called "production curve" of shale wells, either by limiting the initial surge in output or by squeezing a few additional barrels out of older wells, according to industry executives and analysts.

What does all this mean to investors? If you are not already long gold, this is the time to be patiently looking for an entry point. It is not recommend to jump in already now, as gold can typically drop fast and sharp with the aim to shake out weak hands.

Volatility is coming, and, as always, that comes with opportunities for patient investors and traders. Rob Tovell will issue a Trade Alert when an ideal entry point is presenting itself with a signal to go long

Over the 12-year period, Ontario’s net debt ballooned by $10,292 per person, which was the largest per-capita increase in the country.

The Coming Collapse of Saudi Arabia

They met in secret to plan a devastating attack…

Two powerful men, colluding at a palace in the Middle East.

In September 2014, U.S. Secretary of State John Kerry flew to Saudi Arabia. He was there to meet with King Abdullah, the country’s ruler and one of the richest men in the world.

Informed observers say Kerry and Abdullah drew up a plan at this meeting to destroy their common enemies: Russia and Iran.

To carry out the attack, they wouldn’t use fighter jets, tanks and ground troops. They would use a much more powerful weapon…