Red Ponzi Ticking—-China And The Dark

Side Of The Global Bubble, Part 1

Donald Trump is absolutely correct that China is a great economic menace. But that’s not owing to incompetence at the State and Commerce Departments or USTR in cutting bad trade deals.

Nor is it even primarily due to the fact that China egregiously manipulates it currency, massively subsidizes its exports, wantonly steals technology, chronically infringes patents and hacks propriety business information like there is no tomorrow.

If that were the extent of China’s sins, a new sheriff in the White House wielding a big stick and possessing a steely backbone—-attributes loudly claimed by The Donald—-might be able to reset the game. After hard-nosed negotiations, he might even obtain a more level and transparent playing field, thereby eventually reducing our current debilitating $500 billion import trade with China and retrieving at least some of the millions of jobs which have been off-shored to the far side of the planet.

But as we demonstrated in Chapter 5, the world fundamentally changed in the early 1990s when Mr. Deng and Chairman Greenspan jointly initiated the present era of Bubble Finance. The latter elected to inflate rather than deflate the domestic US economy and to thereby export dollar liabilities in their trillions to the rest of the world.

At the same time, having depreciated the yuan by 60%, Mr. Deng discovered that to keep China’s nascent export machine booming he needed to run the printing presses in the basement of the People Bank of China (PBOC) red hot, thereby sopping up the massive inflow of Greenspan’s dollars and keeping China’s exchange rate pegged to the US dollar.

So doing, Beijing kept domestic wages and prices cheap and turned China into an export powerhouse by draining its vast rice paddies of history’s greatest warehouse of untapped industrial labor. In fact, in less than two decades it mobilized more new industrial workers than had existed in the US, Europe and Japan combined at the time in the early 1990s when Mr. Deng proclaimed that it was glorious to be rich.

Unfortunately, that wasn’t the half of it. Greenspan’s dollar profligacy was inherently contagious. By the 1990s, the governments of most of the developed world were run by statists and socialists who were loath to see their exchange rates soar in the face of Greenspan’s epic flood of surplus dollars.

So rather than harvesting social gains from the cheap American exports Greenspan had on offer, the new ECB and the BOJ reciprocated with monetary expansion designed to keep their exchange rates down and protect domestic industries and labor .

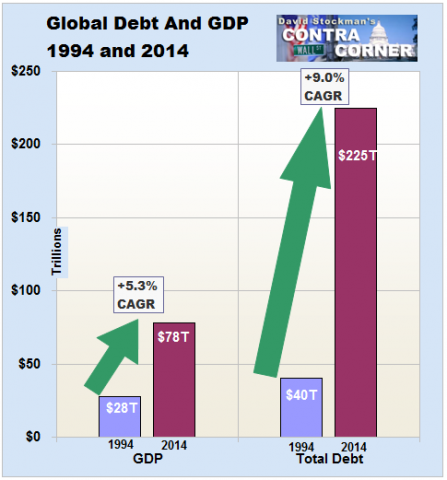

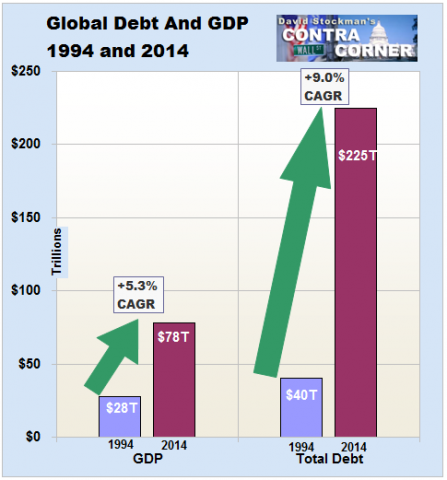

Old fashioned economists were wont to call this a race to the currency bottom, and surely it was that. But what it really did was unleash a global tsunami of credit expansion and an economic race of another sort. Namely, to today’s nearly universal malady of Peak Debt.

As we documented earlier, the combined central banks of the world have expanded their balance sheets from $2 trillion to $21 trillion or by 10Xduring the past two decades. So doing they drove the price

There are certainly some things I love about the geographic region of Canada. I’m a life long hockey fan which I consider to be the best sport in the world (along with Mixed Martial Arts)… and Canada is ALL about hockey. It could be dead in the heat of summer (which lasts about six weeks and all anyone talks about is hockey). And, there are plenty of other things to like about Canada too. But given the high level of socialism/statism and the incredibly cold temperatures, it definitely wasn’t enough to make me want to give up half my life earnings just to stay there.

“We understand the deep frustration and concerns associated with the cost of the EpiPen to the patient, and have always shared the public’s desire to ensure that this important product be accessible to anyone who needs it,” Heather Bresch, chief executive of Mylan, said in a statement, calling the company’s move “an extraordinary commercial response.”

Simplifying the process is a focus only on the structural elements of the argument, particularly foreign policy, military strategy, and technology, that interrelate in a manner that produce a cogent argument on why this a Prevailing Gray Swan and not just “another Middle East war” which breeds complacency. The primary message to Americans is that the Syrian Conflict should not be viewed in the same class as regional wars like Iraq and Afghanistan because the Syrian Conflict can quickly become a war directly between the US/NATO forces versus Russia/Iran and not just second-world militaries and/or proxies of the US and Russia fighting in limited geographies with conventional weapons in the recent past.

Wind Power Finally Getting Out From Solar’s Shadow

Wind power Solar power has been getting all of the proverbial sunlight for the last few years. Most of the focus and attention from environmentalists, regulators, and others has been on solar. There are numerous pure-play solar companies from SolarCity to First Solar. Solar is commonly used in residential applications today, and economic pundits fall all over themselves to talk about the falling cost of solar panels and the changing economics that entails. All of that attention has probably left wind power advocates feeling a little steamed. While there are many pure-play public solar companies, there are few publicly-traded firms investing directly in wind farms or producing wind turbine equipment. Yet wind power is every bit as viable a technology as solar, and in some respects is a natural complement to solar – wind often blows hardest at night and on stormy days – exactly when solar is the […]