Stocks Correct, Panic Ensues. The End Of The World?

The four major U.S. stock market indices finally corrected after a 9-month sideways trend. The ‘big’ news this week for stocks was undoubtedly that the four indices all closed below their 200-day moving average, which IS an important breakdown.

At Secular Investor, we believe the TED-spread is one of the most reliable indicators of stress in the financial system. It should be considered a ‘seismograph’ signaling that something is brewing, as explained some time ago here.

The TED-spread has ‘broken out’ this week, after a steady rise for a year and a half. It now has the highest reading since ‘QE infinity’ started at the end of 2012.

Commodity prices just slumped to their lowest level since the end of the 20th century, according to a widely used Bloomberg index.

The index is made up of 22 major traded commodities and has been sliding recently, but the chaos in Asian markets hit prices particularly hard on Monday.

This Agenda is a plan of action for people, planet and prosperity. It also seeks to end poverty and hunger, and ensure that all human beings can fulfil their potential in dignity and equality and in a healthy environment.

the 2030 Agenda is a template for governing the entire planet.

Earth ‘overshoot day’ – the day each year when our demands on the planet outstrip its ability to regenerate – comes six days earlier than 2014, with world’s population currently consuming the equivalent of 1.6 planets a year

Earth ‘overshoot day’ – the day each year when our demands on the planet outstrip its ability to regenerate – comes six days earlier than 2014, with world’s population currently consuming the equivalent of 1.6 planets a year

The devaluations tend to have a cascading effect, with other emerging markets coming under increasing pressure from their competitors.

Solar cells are based on semiconductor materials. Non-conductors—into which we will carelessly toss semiconductors—have what is called a bandgap. This is the energy required to excite an electron from a bound state to a conducting state. In the bound state, electrons stay in the vicinity of the atoms to which they are attached, while in the conducting state, they are free to move. Solar cells use sunlight to excite electrons from the bound state to the conducting state, and the electrons give up that energy when they perform work for us.

Despite such vast expenditures, rust cannot be stopped, only slowed. No matter how tall our buildings, strong our bridges, or graceful our national monuments, they’re all, ultimately, headed for the trash heap. The best we can do is add another coat of paint and hope to forestall the inevitable. Rust, in other words, reveals a fundamental truth: it’s a red flaky trace of entropy. It ensures that everything that’s here today will be gone tomorrow.

Deflationary Collapse Ahead?

Summation

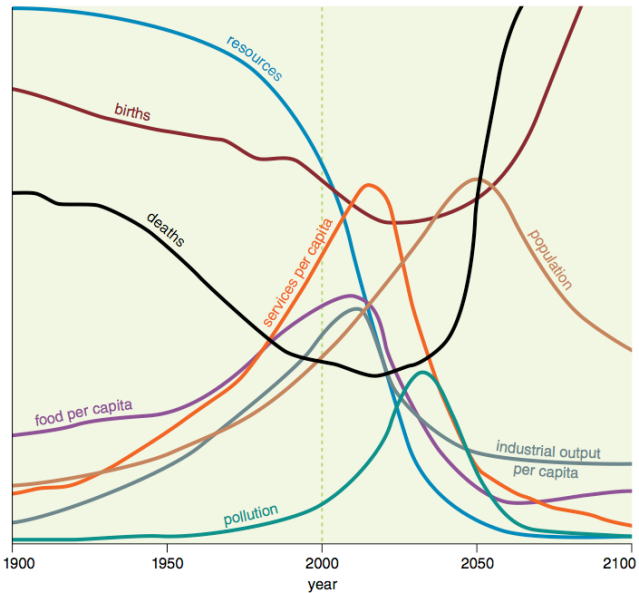

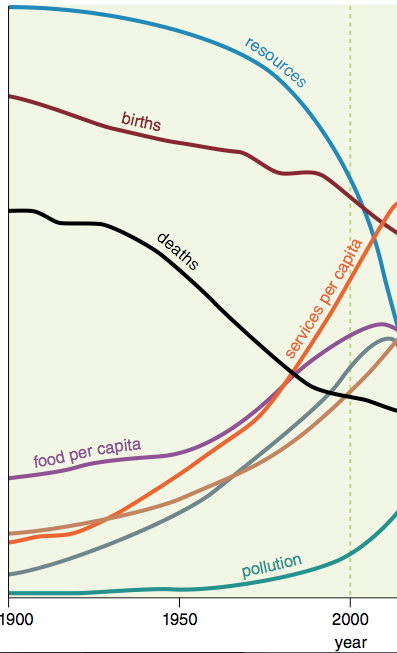

The analysis that comes closest to the situation we are reaching today is the 1972 analysis of limits of a finite world, published in the book “The Limits to Growth” by Donella Meadows and others. It models what can be expected to happen, if population and resource extraction grow as expected, gradually tapering off as diminishing returns are encountered. The base model seems to indicate that a collapse will happen about now.

The shape of the downturn is not likely to be correct in Figure 5. One reason is that the model was put together based on physical quantities of goods and people, without considering the role the financial system, particularly debt, plays. I expect that debt would tend to make collapse quicker. Also, the modelers had no experience with interactions in a contracting world economy, so had no idea regarding what adjustments to make. The authors have even said that the shapes of the curves, after the initial downturn, cannot be relied on. So we end up with something like Figure 6, as about all that we can rely on.

If we are indeed facing the downturn forecast by Limits to Growth modeling, we are facing a predicament that doesn’t have a real solution. We can make the best of what we have today, and we can try to strengthen bonds with family and friends. We can try to diversify our financial resources, so if one bank encounters problems early on, it won’t be a huge problem. We can perhaps keep a little food and water on hand, to tide us over a temporary shortage. We can study our religious beliefs for guidance.

Some people believe that it is possible for groups of survivalists to continue, given adequate preparation. This may or may not be true. The only kind of renewables that we can truly count on for the long term are those used by our forefathers, such as wood, draft animals, and wind-driven boats. Anyone who decides to use today’s technology, such as solar panels and a pump adapted for use with solar panels, needs to plan for the day when that technology fails. At that point, hard decisions will need to be made regarding how the group will live without the technology.

We can’t say that no one warned us about the predicament we are facing. Instead, we chose not to listen. Public officials gave a further push in this direction, by channeling research funds toward distant theoretically solvable problems, instead of understanding the true nature of what we are up against. Too many people took what Hubbert said literally, without understanding that what he offered was a best-case scenario, if we could find something equivalent to a perpetual motion machine to help us out of our predicament.

Learning Success:

APPLY Tips From The Best