A selloff in emerging-market assets accelerated as currencies deepened their slump against the dollar amid mounting speculation that a U.S. interest-rate increase is imminent and energy stocks tumbled with oil prices.

Russia’s ruble fell for a second day as crude, the country’s biggest export, sank on concern a global supply glut will be prolonged. Brazilian bond yields rose to a record as President Dilma Rousseff suffered a setback in Congress that eroded measures to pare budgets and avoid a junk credit rating. The MSCI Emerging Markets Index traded at a more than two-year low as energy companies tumbled.

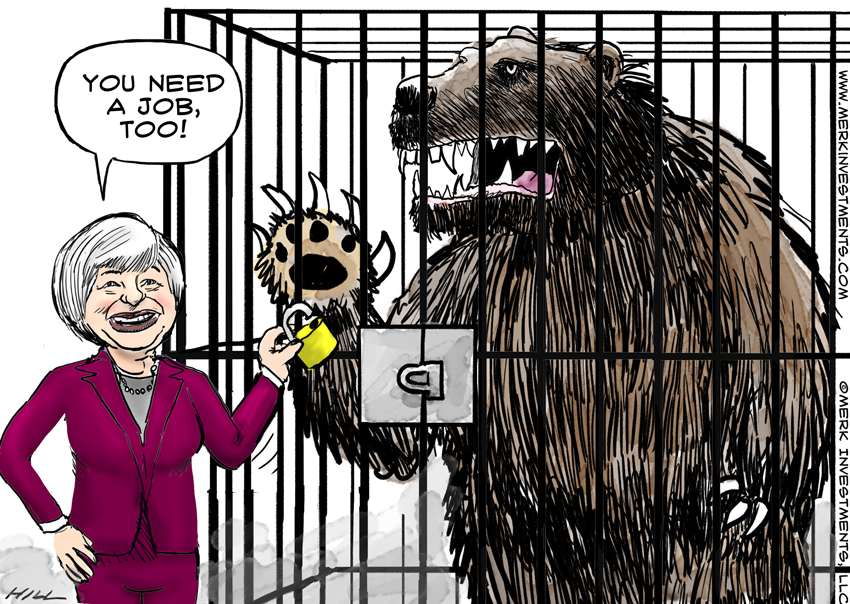

Developing-nation stocks, bonds and currencies have been dragged down by growing evidence that the U.S. economy is improving enough to embolden the Federal Reserve to raise borrowing costs for the first time since 2006 as soon as next month. The Fed’s near-zero interest rates have supported demand for riskier assets in emerging nations. Data on Thursday that showed filings for U.S. unemployment benefits near four-decade lows further bolstered the case for an increase.

Marc Faber – The Fed Has No Intention To Raise Rates

With the U.S. economic recovery being doubted by weaker economic data, and more and more market watchers expecting the Federal Reserve to make a move on rates at a later date, Kitco News speaks with Marc Faber, editor of the Gloom Boom & Doom Report, to find out what he has to say about it. “Given the dollar strength and that most recent economic statistics in the U.S. have been on the weak side, I don’t think the Fed has any intention whatsoever to increase rates,” he says, adding that if they do they will make sure that the increase would stay below the cost of living. “In other words, we would still have negative real interest rates,” he explains. Looking to gold, Faber says considering gold’s current price compared to the highs of 2011, he thinks this is a “reasonably good entry point.” Finally, Faber comments on Europe, which he says might outperform the U.S. economy this year. “Most of the European markets – I’m not saying all, I’d say Germany, France, Italy – they’re up something like 10% in dollar terms. I think 2015 will see a year where Europe outperforms the U.S. massively.”

Here's the Next Crisis "Nobody Saw Coming"

When borrowing become prohibitive (or impossible) and raising taxes no longer generates more revenues, state and local governments will have to cut expenditures.

"Strangely enough, every easily foreseeable financial crisis is presented in the mainstream media as one that "nobody saw coming."

No doubt the crisis visible in these three charts will also fall into the "nobody saw it coming" category.

Take a look at this chart of state and local government debt. As we noted yesterday, nominal GDP rose about 77% since 2000. So state and local debt rose at double the rate of GDP. That is the definition of an unsustainable trend

Earlier this year, as the market kept marching upward, I decided that buying put options on equities wouldn’t give me the kind of protection I was looking for. So I liquidated most of my equity holdings. We also shut down our equity strategy for the firm.

Of late, I’ve taken it a step further, starting to build an outright short position on the market. In the long-run, this may be losing proposition, but right now, I am rather concerned about traditional asset allocation.

This money bubble is going to pop. It has to because there is just too much debt in the world. That debt has to be reconciled and, ultimately, when you are reconciling debt, it gets back to the point about collateral on the balance sheets. There is just not enough good collateral to support all of this paper money circulating out there

The coverage of the TPP in the media was schizophrenic, on the one hand describing it as part of Obama’s “pivot to Asia” (as in an effort to contain China’s growing hegemony), meaning it was clearly a political enterprise, an “everybody but China” deal, and on the other hand, saying that the reason Americans should support it was those miniscule trade benefits. And of course, there was nary a mention of the cost in terms of national sovereignity.

“More people are finding jobs, but nobody feels optimistic about their income prospects,” he added. “That’s likely why it doesn’t feel like the economy has really recovered even though the statistics say it has.”

On a related matter—whether or not the nuclear agreement represents a bad deal for the people of Syria, who suffer under the Iran-supported Assad regime, which will presumably benefit financially from the lifting of sanctions on its primary sponsor—Kerry was somewhat dismissive. In response to my question, “Does it bother you that money will be going to Assad and Hezbollah?,”

Kerry responded, “Yes, but it’s not dispositive. It’s not money that’s going to make a difference ultimately in what is happening.”

Canada

Of A‘Very Unusual

Recession’

Canada is teetering on the edge of a recession.

The country's GDP has fallen for five straight months, the latest numbers coming in at a 0.2 percent contraction in May. And economists say Canada is about to hit its second-straight quarter of declining GDP, the technical definition of a recession.

Contributing to Canada's problems include plunging commodities prices, slowing exports and a falling Canadian dollar. The tumble in crude oil, which has fallen more than 15 percent year to date, has hit Canada hard as a commodities-heavy economy.

According to TD Bank's deputy chief economist, Derek Burleton, investor concerns about the Canadian economy date back to last year, when oil prices first began to fall.

"They're worried about Canada; they're still short Canada," Burleton said. "There's not a lot of upside to growth."

Learning Success:

APPLY Tips From The Best

APPLY Tips From The Best

Warren Buffett, Berkshire Hathaway – He is a deeply conservative trader during the times that everyone around him is moving from one extreme to the other to the tune of huge losses and gains. Warren Buffett is a perfect example of patience, proving that slow and steady generally wins the business race. (Although I continue to press my own desire to spur Fishbowl’s inventory software business to race!)

Warren Buffett, Berkshire Hathaway – He is a deeply conservative trader during the times that everyone around him is moving from one extreme to the other to the tune of huge losses and gains. Warren Buffett is a perfect example of patience, proving that slow and steady generally wins the business race. (Although I continue to press my own desire to spur Fishbowl’s inventory software business to race!)

Top Weekly Ideas and Insights

An Inconvenient Truth:

An Inconvenient Truth:

What Happens When Top Economists Realize Physical Growth Constraints?

EXISTENTIAL REALITY

"Humanity's Coming of Age"

- The Last Days of Economic Growth -