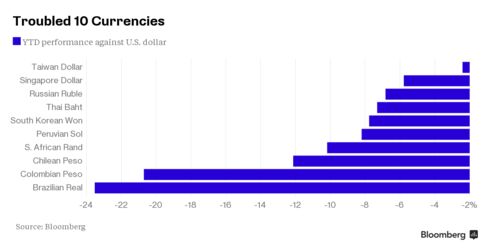

Morgan Stanley's Fragile Five

Swells To Troubled 10

In Selloff

Forget the “Fragile Five.” These days, strategists at Morgan Stanley are worried about what could be called the “Troubled Ten.”

That’s how many nations they say are particularly at risk since China devalued the yuan. While the analysts haven’t used the term themselves, it’s as good a description as any for the currencies -- from the Brazilian real to Peru’s sol and South Korea’s won -- which have trading ties making them susceptible to a slowdown in the world’s second-biggest economy.

“It’s all about vulnerability,” said Hans Redeker, the London-based global head of foreign-exchange strategy at Morgan Stanley. “Major victims of the policy change this time are currencies of countries with high export exposure and export competitiveness with China.”

That’s how many nations they say are particularly at risk since China devalued the yuan. While the analysts haven’t used the term themselves, it’s as good a description as any for the currencies -- from the Brazilian real to Peru’s sol and South Korea’s won -- which have trading ties making them susceptible to a slowdown in the world’s second-biggest economy.

“It’s all about vulnerability,” said Hans Redeker, the London-based global head of foreign-exchange strategy at Morgan Stanley. “Major victims of the policy change this time are currencies of countries with high export exposure and export competitiveness with China.”

Forget the “Fragile Five.” These days, strategists at Morgan Stanley are worried about what could be called the “Troubled Ten.”

“It’s all about vulnerability,” said Hans Redeker, the London-based global head of foreign-exchange strategy at Morgan Stanley. “Major victims of the policy change this time are currencies of countries with high export exposure and export competitiveness with China.”

http://www.bloomberg.com/news/articles/2015-08-16/morgan-stanley-s-fragile-five-swells-to-troubled-10-in-selloff

23 Nations Around The World Where Stock Market Crashes Are Already Happening

You can stop waiting for a global financial crisis to happen. The truth is that one is happening right now. All over the world, stock markets are already crashing. Most of these stock market crashes are occurring in nations that are known as “emerging markets”. In recent years, developing countries in Asia, South America and Africa loaded up on lots of cheap loans that were denominated in U.S. dollars. But now that the U.S. dollar has been surging, those borrowers are finding that it takes much more of their own local currencies to service those loans. At the same time, prices are crashing for many of the commodities that those countries export. The exact same kind of double whammy caused the Latin American debt crisis of the 1980s and the Asian financial crisis of the 1990s.

As you read this article, almost every single stock market in the world is down significantly from a record high that was set either earlier this year or late in 2014. But even though stocks have been sliding in the western world, they haven’t completely collapsed just yet.

Bush explicitly exempted fracking operations from key provisions of the Safe Drinking Water Act. These exemptions from a fundamental environmental protection law provided the oil and gas industry the immunity to develop a highly polluting process on a grand national scale.

Solar pricing is now cheaper than new imported thermal coal-fired power plants. Thus it is irrational to build another power plant fuelled by imported coal. The death knell for the seaborne traded coal industry has sounded.

When discussing what makes a difference in the health of

Canadians, we tend to think first of the health care system.

Doctors and hospitals, physiotherapists and pharmacies;

these things are important. But they are far less important

than other elements of people’s lives.

Low interest rates act as a boost to the economy; they spur

lending and encourage spending capital. Higher interest

rates do the opposite; they suppress lending, and encourage

saving — both of which slow an economy.

In other words, if rates were to lift off in a fragile economy,

one like we have, it could cause a greater collapse than the

financial crisis because the few people who are spending

now would stop and sock their wealth away in savings to

enjoy the higher rates.

Looking Back

lending and encourage spending capital. Higher interest

rates do the opposite; they suppress lending, and encourage

saving — both of which slow an economy.

one like we have, it could cause a greater collapse than the

financial crisis because the few people who are spending

now would stop and sock their wealth away in savings to

enjoy the higher rates.

Looking Back

Why Southeast Asia's Boom Is A Bubble-Driven Illusion

Since the Global Financial Crisis, Southeast Asia has been one of the world’s few bright spots for economic growth and investment returns. With its relatively young population of 600 million and its growing middle class, Southeast Asia has been the scene of a modern-day gold rush as international companies clamor to get a piece of the action. Unfortunately, my research has found that much of this region’s growth in recent years has been driven by ballooning credit and asset bubbles – a pattern that is also occurring in numerous emerging economies across the globe.

Since the Global Financial Crisis, Southeast Asia has been one of the world’s few bright spots for economic growth and investment returns. With its relatively young population of 600 million and its growing middle class, Southeast Asia has been the scene of a modern-day gold rush as international companies clamor to get a piece of the action. Unfortunately, my research has found that much of this region’s growth in recent years has been driven by ballooning credit and asset bubbles – a pattern that is also occurring in numerous emerging economies across the globe.

In the past few months, I have published reports about the growing bubbles inSingapore, Malaysia, Thailand, the Philippines, and Indonesia, and I will use this report to explain the region’s economic bubble as a whole. My five Southeast Asian country reports have generated quite a bit of interest and controversy, and were read nearly 1.3 million times, and were publicly denied by the central banks of Singapore, Malaysia, and the Philippines.

Top Weekly Ideas and Insights

Top Weekly Ideas and Insights