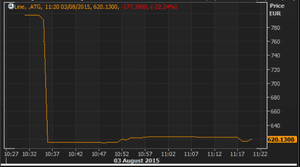

Greece debt crisis: Athens stock market falls 23% as manufacturing plunges

Heavy losses in Athens as trading resumes

The market has opened and it’s not pretty. The Athex Composite has plunged more than 20%, to 615.12. The falls are even deeper in financials, with banking shares down by as much as 30% – the maximum allowed. Market observers caution, however, that we will not know the true picture until things settle down a bit in a few hours’ time.

The Economic And Financial Problems In Europe Are Only Just Beginning…

Right now, the financial world is focused on the breathtaking stock market crash in China, but don’t forget to keep an eye on what is happening in Europe. Collectively, the European Union has a larger population

Right now, the financial world is focused on the breathtaking stock market crash in China, but don’t forget to keep an eye on what is happening in Europe. Collectively, the European Union has a larger population

than the United States, a larger economy than either the U.S. or China, and the banking system in Europe is the biggest on the planet by far. So what happens in Europe really matters, and at this point the European economy is absolutely primed for a meltdown. European debt levels have never been higher, European banks are absolutely loaded with non-performing loans and high-risk derivatives, and the unemployment rate in the eurozone is currently more than double the unemployment rate in the United States. In all the euphoria surrounding the “deal” that temporarily kept Greece in the eurozone, I think that people have forgotten that the economic and financial fundamentals in Europe have continued to deteriorate. Whether Greece ultimately leaves the eurozone or not, a great financial crisis is inevitably coming to Europe. It is just a matter of time.

In many ways, the economy of Europe is in significantly worse shape than the U.S. economy. Just recently, the IMF issued a report which warned that the eurozone is “susceptible to negative shocks” and could be facing very tough economic times in the near future.

In many ways, the economy of Europe is in significantly worse shape than the U.S. economy. Just recently, the IMF issued a report which warned that the eurozone is “susceptible to negative shocks” and could be facing very tough economic times in the near future.

The bear market in bullion is an artificial creation.

Populations in many regions are still young. In Africa, children under 15 account for two fifths of the population.

debt is considered to be just part of normal life. We go into debt to go to college, we go into debt to buy a vehicle, we go into debt to buy a home, and we are constantly using our credit cards to buy the things that we think we need.

Moments ago energy titan Exxon Mobile, which not too long ago was bigger than AAPL by market cap, and is now roughly half the size of the phone maker, reported earnings which were, in a word, carnage. Starting at the bottom, EPS of $1.00 was not only a big miss to already reduced expectations of $1.11, but also the worst quarter since 2009.

Moments ago energy titan Exxon Mobile, which not too long ago was bigger than AAPL by market cap, and is now roughly half the size of the phone maker, reported earnings which were, in a word, carnage. Starting at the bottom, EPS of $1.00 was not only a big miss to already reduced expectations of $1.11, but also the worst quarter since 2009.

On a conference call yesterday Home Capital CEO Gerald Soloway insisted that the problem with its brokers was not an indication of a mortgage fraud crisis across Canada. Home Capital's delinquencies remain low, and the company says it has stopped doing business with the brokers that investigators had shown to be pretending customers' income qualified them for mortgages.

“If we go 100% electronic, the banks can decide to charge you whatever you want in each transaction, the government gets to tax every transaction immediately.”

Seth Klarman used to manage the fourth largest hedge fund in the US. A legendary value investor (copies of his book Margin of Safety sells for over $1,500 on Amazon), Klarman returned billions in assets under management to outside investors citing “too few” opportunities in the market (again, a legend stating that the market was overvalued).

Warren Buffett, perhaps the single biggest cheerleader for stocks in the last 100 years, is sitting on a record amount of cash. The reason is obvious: the market is dangerously overpriced.

Learning Success:

APPLY Tips From The Best

Warren Buffett, Berkshire Hathaway – He is a deeply conservative trader during the times that everyone around him is moving from one extreme to the other to the tune of huge losses and gains. Warren Buffett is a perfect example of patience, proving that slow and steady generally wins the business race. (Although I continue to press my own desire to spur Fishbowl’s inventory software business to race!)

Warren Buffett, Berkshire Hathaway – He is a deeply conservative trader during the times that everyone around him is moving from one extreme to the other to the tune of huge losses and gains. Warren Buffett is a perfect example of patience, proving that slow and steady generally wins the business race. (Although I continue to press my own desire to spur Fishbowl’s inventory software business to race!)

Top Weekly Ideas and Insights

What Happens When Top Economists Realize Physical Growth Constraints?

EXISTENTIAL REALITY

"Humanity's Coming of Age"

- The Last Days of Economic Growth -