Ontario debt to soar by $50 billion

over four years: FAO

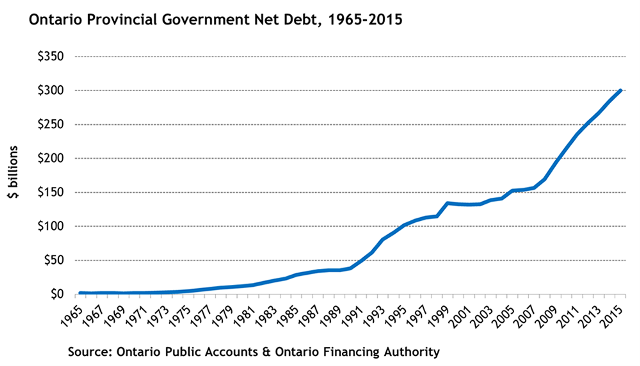

TORONTO - Ontario’s debt is set to jump by $50 billion over

the next four years, the province’s financial watchdog warns.

Financial Accountability Officer Stephen LeClair says

Ontario’s net debt will reach $350 billion by 2020-21. The

FAO warns that

Ontario’s debt

burden is one of the

highest

among Canada’s

provincial

governments and an

interest rate

hike could put its credit and “fiscal flexibility” at risk.

“You do have to be cautious about the amount that you

borrow,” LeClair said. “I do recognize that the government is

borrowing to finance some of their capital build and that will

provide benefits to the province. But you still have to service

that debt, and at some point in time, interest rates may rise,

which will require a greater amount to service debt.”

As of March 31, 2016, Ontario’s debt sat at $296.1 billion.

LeClair notes that in the previous fiscal year, 2014-15,

Ontario had the highest debt burden among the country’s

major provinces, “carrying $2.40 in net debt for each dollar

of provincial revenue.”

LeClair also notes that 38% of Ontario’s current net debt

comes due in 2020. The province could “roll over” the debt,

which means taking on more debt to pay off the existing

balance.

LeClair also notes that 38% of Ontario’s current net debt

comes due in 2020. The province could “roll over” the debt,

which means taking on more debt to pay off the existing

balance.

“In key respects, middle-income families with children now more closely resemble poor families than in the past,” the IFS said. “Half are now renters rather than owner-occupiers and, while poorer families have become less reliant on benefits as employment has risen, middle-income households with children now get 30% of their income from benefits and tax credits, up from 22% 20 years ago.”

Almost a third of Russians now buy less food than before, while 49 percent admit they save on medicine by ignoring doctor prescriptions if the treatment is too expensive, recent surveys found. Some two-thirds say prices of goods and services bought by their families are rising at double the pace of officially reported inflation if not faster.

The combined pension deficit for S&P 1500 companies ballooned to $568 billion at the end of June, a $164 billion increase from the end of 2015, according to Mercer, a benefits consulting firm.

The company said it expected the program, often called Obamacare, to reduce 2016 earnings by about $850 million, up from $475 million in 2015. Next year, it will exit most of the two dozen states where it sells individual insurance on the exchanges but still has plans to sell in Nevada, New York and Virginia.

Exxon Mobil bids $2.2 billion for Inter Oil, may spark bidding war

The logo of Exxon Mobil Corporation is shown on a monitor above the floor of the New York Stock Exchange in New York, December 30, 2015. ExxonMobil Corp has made a bid worth at least $2.2 billion for Papua New Guinea-focused InterOil Corp ( IOC.N ), winning the support of InterOil and topping an offer from Oil Search Ltd ( OSH.AX ), Oil Search said on Monday. ExxonMobil’s move pits it against French giant Total SA (TOTF.PA ), which is backing Oil Search’s offer with an agreement to buy part of InterOil’s stake in the potentially lucrative Elk-Antelope gas field. Oil Search has at least until July 21 to submit a revised offer and said it was talking to Total about making a higher bid. “The parties are in active dialogue and have the flexibility to submit a revised offer either during the three day notice period or […]