Record Bond and Stock Prices Sending the Same Message

The S&P 500 is trading near an all-time record high. But investors should not take this as the all clear signal. According to most indicators, the market is now more overvalued than ever before.

The Cyclically Adjusted Price to Earnings Ratio analyzes the value of the S&P 500 Index with the 10-year average of "real" (inflation-adjusted) earnings as the denominator to determine if the market as a whole is overvalued or undervalued. Today this ratio sits at 26.73, close to the short-term high of 27.2 seen in 2007 and well above its historic average of around 16.

Then we have the Q ratio, developed by James Tobin. This metric takes the total price of the market divided by the replacement cost of all its companies’ assets. The average Q ratio is .68, but the latest estimate of the Q ratio .98. This suggests that the S&P 500 is currently dramatically above the mean.

Adding to this, the total market cap of U.S. stocks is now 122.5% of GDP. This is the highest level since mid-2000, which was during the NASDAQ bubble. This measure reached its peak at 142%, before crashing back to the more traditional level of just 70% by 2002.

And last we have the Price to Sales Ratio of the S&P 500. It is a measure of the Index’s value compared to its sales. The most recent Price to Sales is estimated at 1.91, in December of 2015 it was 1.81 and in 2007 it was 1.43. This metric shows the market is vastly overvalued compared to firms’ revenue.

The S&P 500 is trading near an all-time record high. But investors should not take this as the all clear signal. According to most indicators, the market is now more overvalued than ever before.

The Cyclically Adjusted Price to Earnings Ratio analyzes the value of the S&P 500 Index with the 10-year average of "real" (inflation-adjusted) earnings as the denominator to determine if the market as a whole is overvalued or undervalued. Today this ratio sits at 26.73, close to the short-term high of 27.2 seen in 2007 and well above its historic average of around 16.

Then we have the Q ratio, developed by James Tobin. This metric takes the total price of the market divided by the replacement cost of all its companies’ assets. The average Q ratio is .68, but the latest estimate of the Q ratio .98. This suggests that the S&P 500 is currently dramatically above the mean.

Adding to this, the total market cap of U.S. stocks is now 122.5% of GDP. This is the highest level since mid-2000, which was during the NASDAQ bubble. This measure reached its peak at 142%, before crashing back to the more traditional level of just 70% by 2002.

And last we have the Price to Sales Ratio of the S&P 500. It is a measure of the Index’s value compared to its sales. The most recent Price to Sales is estimated at 1.91, in December of 2015 it was 1.81 and in 2007 it was 1.43. This metric shows the market is vastly overvalued compared to firms’ revenue.

On top of the economic and moral perversity within each country of punishing the productive and subsidizing the unproductive, another layer of international income- and wealth-redistribution is added: of punishing economically better performing countries like Germany and the countries of northern Europe and rewarding economically worse performing countries (mostly of southern Europe) and thus successively rendering the economic performance of all countries equally worse.

When the war ended, Soros moved to London and in 1947 enrolled in the London School of Economics where he studied under Karl Popper, the Austrian-British philosopher who was one of the first proponents of an “Open Society.”

Soros then worked at several merchant banks in London before moving to New York in 1963. In 1970, he founded Soros Fund Management and in 1973 created the Quantum Fund in partnership with investor Jim Rogers

“We are in a slow weak-growth environment,” said Jonathan Golub, senior equity strategist at RBC Capital Markets, who recently cut his earnings forecast for the S&P 500, saying profits will be slightly lower for the year. “What investors are looking for is confirmation that we are not stuck in negative territory.”

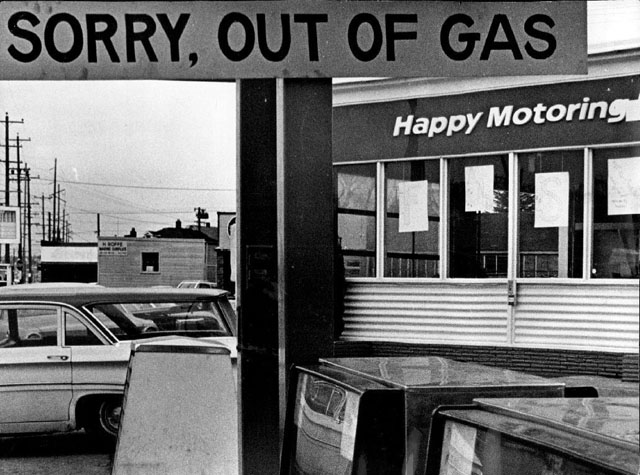

Independent US oil producers seek ban on crude imports

Months after the US energy industry triumphed in overturning an oil export ban, a group of independent producers wants to take policy one step further and curtail crude imports. The Panhandle Import Reduction Initiative has begun campaigning for quotas on all foreign suppliers excluding Canada and Mexico. Its founders, Texas and New Mexico oilmen, said Saudi Arabia is trying to crush their industry and it’s time to fight back. “It’s not fair and it’s not free when a country is trying to drive individual producers in the United States out of business,” said Tom Cambridge, an oil producer in Amarillo, Texas. “What we would like to do is limit imports.” The push comes two years after crude first dropped below $100 a barrel. In late 2014 Saudi Arabia and other Opec members resolved to keep taps open despite falling prices, hastening bankruptcy for dozens of US producers.